海角精选视频推荐

每日更新优质原创视频内容,涵盖美妆教程、舞蹈表演、旅行纪实等多元视频类型

12:36

12:36

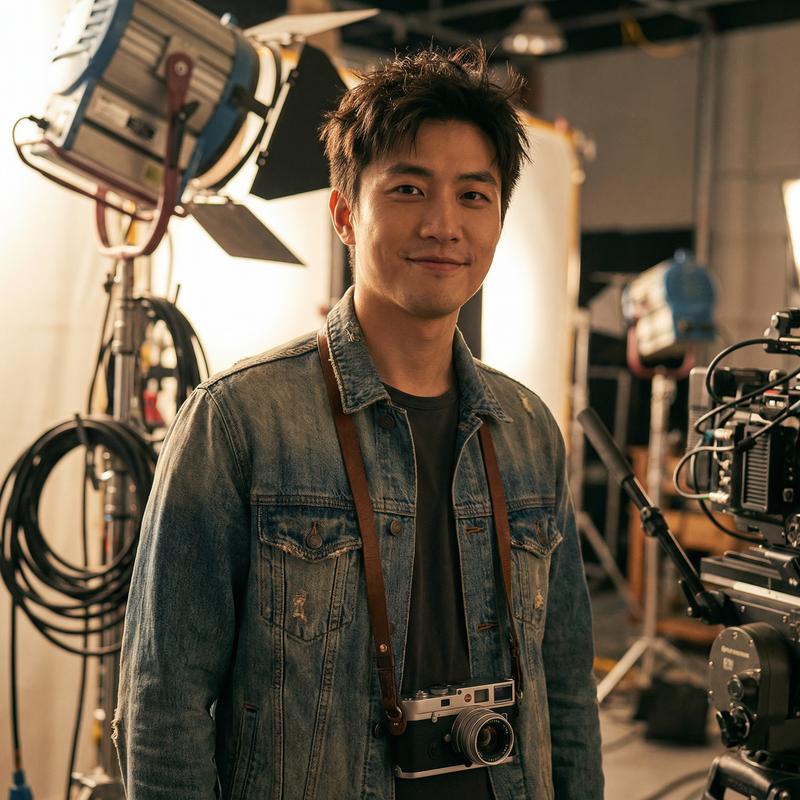

清透日系妆容视频教程 | 五分钟学会自然裸妆

04:22

04:22

唯美现代舞视频演示 | 光影之间的身体语言

08:15

08:15

国风cosplay变装视频 | 从素颜到仙侠角色

15:48

15:48

法式甜品制作视频教程 | 马卡龙与水果塔

20:05

20:05

云端之上的旅行视频分享 | 雪山日出纪实

18:30

18:30

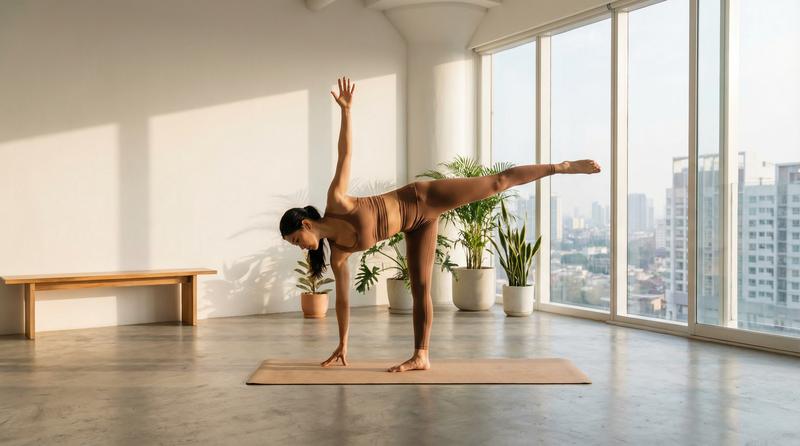

居家瑜伽视频教程 | 初学者身心放松指南

06:12

06:12

独立音乐人弹唱视频 | 温暖治愈的午后旋律

09:44

09:44